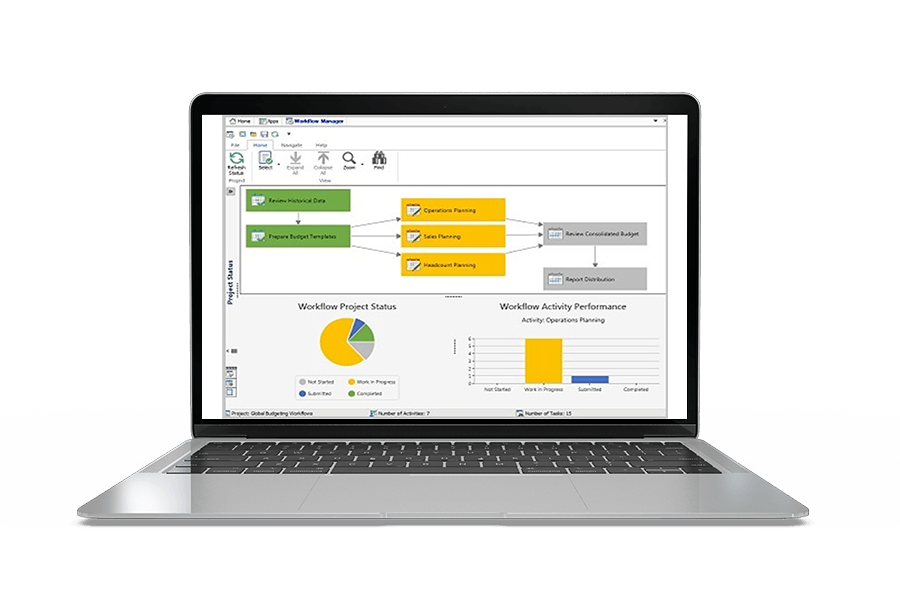

Workflow options eliminate the burden of having to control and remind other stakeholders that they should submit their financial information. Workflow provides a structured authentication process that ensures the validity of data while also ensuring audit trail as all changes are logged.

The use of workflow automates the consolidation process.

An overview is created so that the following is constantly under consideration:

- The process progression

- Who still needs to do what

- The audit trail

- Control

All movements and actions are logged. Thus, it is ensured that the consolidation is transparent and validated